change in net working capital formula

Here you can see the value comes out to be negative. This indicates that the firm is out of funds.

Changes In Net Working Capital All You Need To Know

It is possible to derive capital expenditures for a company.

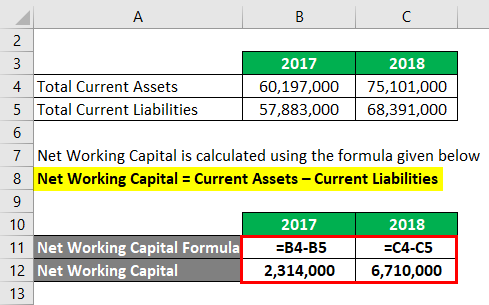

. Changes 2017 AR 2016 AR 2017 Inventory 2016 Inventory 2017 AP 2016 AP Where AR accounts receivable. Change in WC Current year WC Last year WC. Add or subtract the amount.

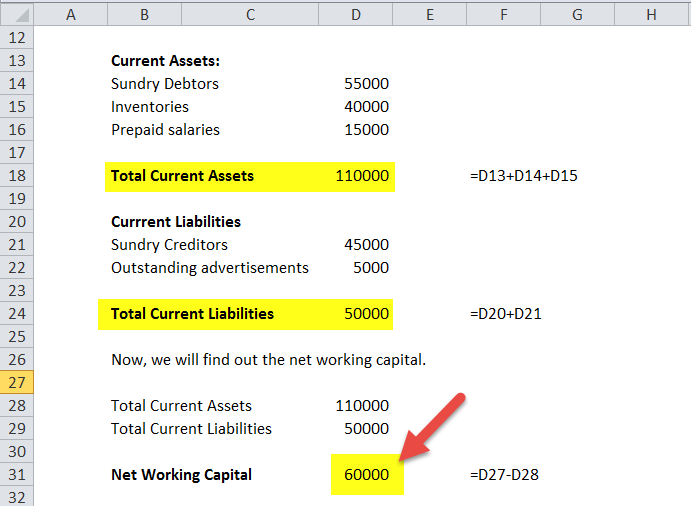

Conversely large companies with positive working capital but a low current ratio might need additional working capital. Because the change in working capital is positive it should increase FCF because it means working capital has decreased and that delays the use ofcash. Changes in the Net Working Capital Change in Current Assets Change in the Current Liabilities.

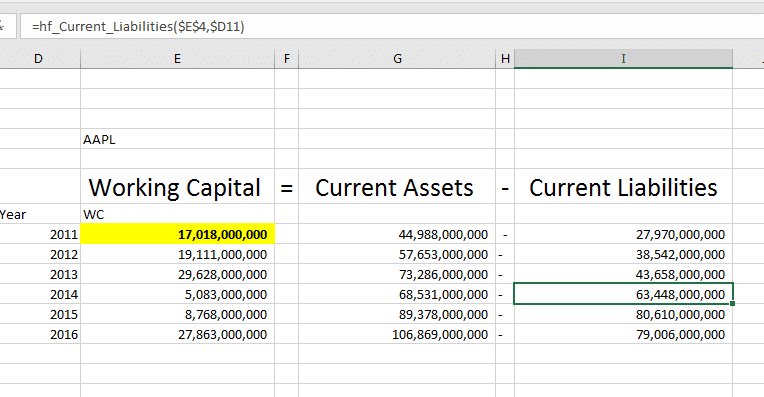

My problem was that I was looking at the numbers too much without seeing the entire picture of cash flow. Change In Net Working Capital Formula. Working Capital Current Assets Current Liabilities.

The last step is to find the change in net working capital. Thus the formula for changes in non-cash working capital is. That difference is the change in working capital.

2016 prior period. To calculate the change you need to determine the net working capital for both the current and previous period and heres the formula. Next compare the firms working capital in the current period and subtract the working capital amount from the previous period.

The working capital formula is. That difference is your working capital WC. Change in Net Working Capital NWC Prior Period NWC Current Period NWC.

Non-cash working capital receivables inventory payables Non-cash working capital 10000 200000 25000 30000 Non-cash working capital 155000 Regardless of the formula they used the investor could determine that the amount of future assets is much higher than the companys liabilities indicating that theres a potential for profit. Current assets current. You can find the net working ratio with this simple calculation.

Posted on January 28 2020 May 16 2022 by admin. As a sanity check you should confirm that if the NWC is growing year-over-year the change should be reflected as a negative cash outflow and the change would be positive cash inflow if the NWC is declining year-over-year. A working capital ratio of less than one means a company isnt generating enough cash.

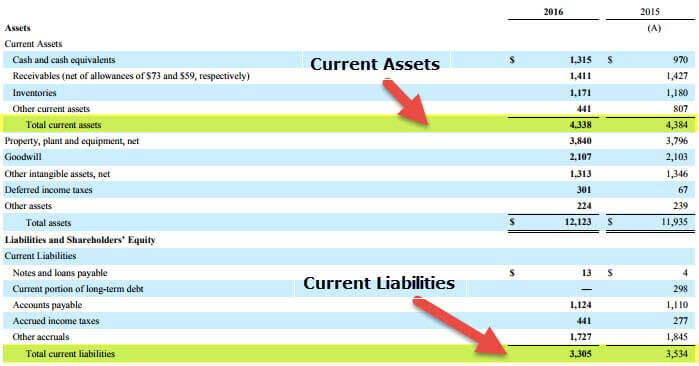

The goal is to. AP accounts payable. The net working capital metric is a measure of liquidity that helps determine whether a company can pay off its current liabilities with its current assets on hand.

Change in NWC Formula. Calculate the change in working capital. Thus the value of working capital in 2021 comes out to be -9972000000.

Thats why the formula is written as - change in working capital. Changes in the Net Working Capital Net Working Capital of the Current Year Net Working Capital of the Previous Year. Thus if net working capital at the end of February is 150000 and it is 200000 at the end of March then the change in working capital was an increase of 50000.

Current assets - current liabilities and expenses total assets. It is a measure of a companys short-term liquidity and is important for performing financial analysis financial modeling and managing cash flow. Since the change in working capital is positive you add it back to Free Cash Flow.

As a routine check you must confirm that if the NWC grows from year to year the change should be reflected as negative cash outflow and the change will be positive cash inflow if the NWC decreases from year to year. The Net Working Capital Change NWC formula subtracts the current periods NWC balance sheet from the previous periods NWC balance sheet. You just need to minus the current years working.

Step 4 Capital Expenditures. The formula to calculate the change in the net working capital is as follows. The formula for working capital is current operating assets minus current operating liabilities.

Determine whether the cash flow will increase or decrease based on the needs of the business. The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off. A business with current assets equal to current liabilities has a net working capital of 0 and a current ratio of one.

Lets understand how to calculate the Changes in the Net Working Capital with the. Changes in the Net Working Capital Formula. The net working capital ratio measures the proportion of a businesss short-term net cash to its assets.

Therefore it is important for you to determine the optimal level of working capital. Since the change in working capital is positive you add it back to Free Cash Flow. 2017 current period.

Small companies could have a high current ratio but not enough working capital to meet any unexpected cash needs. Net working capital for the current period net working capital for the previous period change in net working capital.

Net Working Capital Formula Calculator Excel Template

Net Working Capital Formula Calculator Excel Template

Net Working Capital Definition Formula How To Calculate

Change In Net Working Capital Nwc Formula And Calculator

Change In Net Working Capital Nwc Formula And Calculator

Net Working Capital Definition Formula How To Calculate

Change In Net Working Capital Nwc Formula And Calculator

Net Working Capital Meaning Examples Formula Importance Change Impact

Change In Working Capital How To Interpret And Calculate In Excel With Marketxls

Net Working Capital Definition Formula How To Calculate

Is A House An Asset Or Liability Online Accounting

10 Of 14 Ch 10 Change In Net Working Capital Nwc Explained Youtube

Change In Working Capital Video Tutorial W Excel Download

Change In Net Working Capital Nwc Formula And Calculator

𝟒 𝐄𝐚𝐬𝐲 𝐒𝐭𝐞𝐩𝐬 𝐟𝐨𝐫 𝐂𝐚𝐥𝐜𝐮𝐥𝐚𝐭𝐢𝐧𝐠 𝐂𝐡𝐚𝐧𝐠𝐞s 𝐢𝐧 𝐍𝐞𝐭 𝐖𝐨𝐫𝐤𝐢𝐧𝐠 𝐂𝐚𝐩𝐢𝐭𝐚𝐥 Accounting Drive

11 Of 14 Ch 10 Change In Net Working Capital Nwc Example Youtube

Net Working Capital Formulas Examples And How To Improve It